The Differences Between RRSPs and TFSAs

Planning for retirement is a crucial aspect of financial management, and choosing the right retirement savings account can significantly impact your financial future. Two popular options

are Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs). Each has its unique features and advantages, catering to different financial needs and goals.

RRSP

An RRSP is a tax-advantaged retirement savings account that allows individuals to contribute pre-tax dollars, reducing their taxable income in the year of contribution. The investments in the account grow tax-deferred, meaning you won’t pay taxes on the gains until you withdraw the funds during retirement. However, once you start withdrawing funds, they are subject to ordinary income tax.

Pros:

• Immediate tax benefits

• Ideal for individuals expecting lower tax rates in retirement

Cons:

• By the end of the year that you turn 71, you must close your RRSP—one option when closing your RRSP is to convert it to a Registered Retirement Income Fund (RRIF), but you must start withdrawing money from your RRIF in the year after you open it

• Tax implications upon withdrawal

TFSA

Unlike an RRSP, a TFSA requires contributions with after-tax dollars, meaning you don’t get an immediate tax deduction. However, the real benefit lies in tax-free withdrawals at any time,

making it an attractive option for individuals who want flexibility in accessing their savings.

Pros:

• Tax-free withdrawals at any time

• No required minimum withdrawals during the account holder’s lifetime

Cons:

• No immediate tax benefits

• Contribution limits are subject to annual limits set by the government

Choosing the Right Option

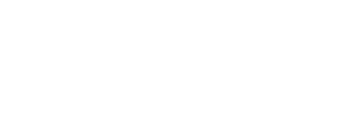

The best retirement savings account for you depends on various factors, including your current financial situation, future tax expectations, and retirement goals. Here are some considerations:

• Current tax bracket: If you are in a high tax bracket now and expect to be in a lower one during retirement, an RRSP might be advantageous

• Future tax expectations: If you anticipate being in a higher tax bracket during retirement or want tax-free withdrawals, a TFSA might be a better fit

• Employer contributions: If your employer offers a RRSP match, it’s often wise to take advantage of this “free money”

• Withdrawal plans: Consider your retirement income needs and how each account aligns with your withdrawal strategy

________________

Understanding the differences between RRSPs and TFSAs is essential for making informed decisions about your retirement savings. Assessing your current financial situation, tax expectations and long-term goals will guide you in selecting the most suitable option or combination of accounts to secure a comfortable retirement. Consult with a financial advisor to

create a personalized retirement strategy based on your unique circumstances.

Downloads

Loading...

Loading...

Loading...

Loading...